MAS imposes cap on housing loan tenures

Singapore regulators signalled their concerns over still rising home

prices yesterday, announcing fresh mortgage curbs to cap upward price

pressures caused by low interest rates and fast credit growth.

The Monetary Authority of Singapore (MAS) said it will set an absolute

limit of 35 years on the tenure of all residential property loans - both

new loans and refinancings. It will also lower loan-to-value (LTV)

ratios for new loans with a tenure of more than 30 years. The new rules

will apply to both private homes and HDB flats and will take effect

today.

"Monetary conditions worldwide are far from normal," said Deputy Prime

Minister Tharman Shanmugaratnam, noting that the latest round of

quantitative easing (QE3) in the United States and low interest rates

have made credit easy, though this will eventually change.

"We are taking this step now to require more prudent lending, and will

continue to watch the property market carefully," said Mr Tharman, who

is also Finance Minister and MAS chairman. "We will do what it takes to

cool the market, and avoid a bubble that will eventually hurt borrowers

and destabilise our financial system."

The new rules - Singapore's sixth round of cooling measures - look set

to affect not just home buyers and existing owners looking to refinance

their mortgages, but also property developers and banks.

According to the central bank, over 45 per cent of new home loans have tenures exceeding 30 years.

MAS will cap the tenure of all new residential property loans at 35 years

For refinancings, the tenure of the refinancing facility and the number

of years since the first home loan for that property was disbursed

cannot add up to more than 35 years.

Also, MAS will lower the LTV ratio for new home loans to individual

borrowers if the tenure exceeds 30 years, or the loan period extends

beyond the retirement age of 65 years.

The LTV will be 60 per cent for a borrower with no outstanding

residential property loan, compared with 80 per cent previously, and 40

per cent for a borrower with one or more outstanding home loans,

compared with 60 per cent before the new rules.

For non-individual borrowers, the LTV ratio for home loans will be lowered to 40 per cent from 50 per cent.

The MAS move comes after the Hong Kong Monetary Authority announced a

30-year limit on the maximum term of all new mortgages last month,

following the launch of QE3. With the Federal Reserve looking to pump

US$40 billion into the US economy each month until sustained jobs growth

kicks in, worries about hot money inflows into Asia and asset price

inflation have again emerged.

Stretched tenures

Previous rounds of cooling measures had a moderating effect on home

prices in Singapore, and a significant supply of housing will also come

onstream in the next two years, MAS noted. "However, prices in both the

HDB resale market and private residential property have continued to

rise in Q2 and Q3 of 2012."

According to official flash estimates on Monday, HDB resale prices rose

2 per cent in Q3 from Q2, while private home prices gained 0.5 per cent

over the same period. Separately, the SRX Residential Property Flash

Report yesterday showed resale prices of non-landed private homes rising

3.2 per cent in Q3.

Low interest rates globally and locally are likely to persist and will

continue to spur residential property demand, pushing up prices beyond

sustainable levels, MAS warned, stressing that "the eventual correction

could be painful to borrowers and destabilise the economy".

Meanwhile, financial institutions have stretched the durations of home

loans, and long tenure loans pose risks to both lenders and borrowers,

the central bank said. The average tenure for new residential property

loans climbed to 29 from 25 years over the last three years, it

revealed. Also, more than 45 per cent of new home loans granted by

financial institutions have tenures exceeding 30 years.

Lower initial monthly repayments from long loan tenures and low

interest rates may cause borrowers to overestimate their loan servicing

ability and take a bigger loan than they can afford, MAS said. In fact,

long tenure loans create a larger debt repayment burden as interest

accumulates over a longer period.

"When interest rates eventually rise, borrowers who have overextended

themselves will have difficulties repaying their loans," MAS said. "If

property prices fall, financial institutions may be caught holding the

bad loans."

Banks which offer home loans with a tenure of over 35 years will feel

the impact of the new rules almost immediately. DBS and OCBC are among

those providing mortgages stretching up to 40 years.

"We will reduce our existing maximum home loan tenure of 40 years to 35

years, with immediate effect," said OCBC group corporate communications

head Koh Ching Ching.

A DBS spokeswoman said that most of the bank's home loans have a tenure

of under 35 years. "It will take some time to ascertain the impact of

the new measures while homebuyers assess the market."

Resale impact

United Overseas Bank (UOB), which introduced 50-year housing loans in

July, did not respond to media queries. Some market watchers then had

questioned if the product would cause borrowers to overextend

themselves, and National Development Minister Khaw Boon Wan subsequently

called it a "gimmick".

Maybank said its maximum loan tenure for home loans is 35 years. "With

an ageing population and couples marrying and setting up home at a later

age, the new rules will have impact on these segments," said Alan Yet,

head of lending (consumer banking) for Singapore.

The jury is out on how the new rules will affect the residential

property market. The Real Estate Developers' Association of Singapore

(Redas) does not expect a significant impact. "Based on past experience,

not many buyers take long tenure loans," it said. Just last week, Redas

said the property sector does not need more cooling measures - at least

not before a thorough review of the impact of earlier policies.

Source: Business Times – 6 October 2012

Mortgage limits may deter older investors

The latest changes to mortgage rules could deter many house-hunters

from buying a new property - or at least give them serious pause,

analysts and property market watchers said yesterday.

Chief among this group will be older investors looking to buy a second or third investment property, they noted.

And HDB upgraders who want to get on the private property ladder will also not be spared.

From today, the Monetary Authority of Singapore (MAS) will cap all new housing loans at a maximum allowable tenure of 35 years.

Tighter rules will also apply to borrowers taking loans longer than 30

years, or have their loan periods extend beyond the retirement age of

65.

If they have no outstanding mortgage, the cash down payment is now 40

per cent of the property's valuation instead of the usual 20 per cent.

If they already have an existing mortgage and want to take another one

for another property, the cash down payment is 60 per cent, instead of

the current 40 per cent.

For these borrowers, the only way to avoid paying the additional 20 per

cent cash down payment is to opt for shorter loan tenures that do not

extend past the age of 65.

But this will mean higher monthly installments.

Source: The Straits Times – 6 October 2012

Market unlikely to be hit hard: Redas

Many developers seem to feel the new cooling measures will not have a

big impact although those with more exposure to the local market could

feel the pinch.

The response to yesterday's announcement from the Monetary Authority of Singapore (MAS) of the new rules was low key.

The Real Estate Developers' Association of Singapore (Redas) issued a

statement saying that the cap "will not have significant impact on the

property market".

"Based on past experience, not many buyers take long tenure loans," it said.

Mr Cheang Kok Kheong, chief executive of Frasers Centrepoint Homes,

said: "We have always been supportive of the Government's measures aimed

at curbing excessive speculative activities, as we believe in the

importance of having a stable and sustainable housing market."

He said the move "is not expected to have a significant impact on the residential market".

A Keppel Land spokesman said: "We believe that there is still genuine

demand for homes and well-located properties with good attributes should

continue to see healthy sales."

Two other developers which declined to be named also said the new measure was not a big issue.

Far East Organization, City Developments, Hong Leong and CapitaLand declined to comment.

Consultants said the new rule to cap mortgages at 35 years could hit

sales as investors and those who are stretching themselves financially

will likely stay away from the market.

Source: The Straits Times – 6 October 2012

Banks wait to gauge impact

Banks could take a hit from the new rules on mortgage tenure but just how much they will be impacted remains unclear.

The Monetary Authority of Singapore (MAS) announced yesterday that a

lower loan-to-value ratio will be imposed on loans with tenure of more

than 30 years, or if the loan tenure extends beyond the borrower's

retirement age of 65.

Bankers said the measures will certainly affect those taking out new

loans and the mortgage-refinancing side of the lending business.

The most practical impact will be seen on older home-buyers. Those over

35 will have to take up a loan tenure of less than 30 years if they do

not want to be affected by the lower loan-to-value ratio linked to the

retirement age of 65.

Mr Dwaipayan Sadhu, Standard Chartered Bank's head of consumer

transaction banking and mortgage for Singapore and South-east Asia,

believes the new rules may also impact younger customers. He said:

"Their monthly cash outflow would increase should they opt for 30-year

loans instead of the current 35."

Maybank Singapore's head of lending business (consumer banking), Mr

Alan Yet, agreed the refinancing market will likely be affected, but

noted that as with earlier cooling measures, it does take time before

the effects are seen.

Other experts think, however, that the impact could be muted.

Source: Business Times – 6 October 2012

Non-landed private home resale prices up 3.2%

Resale prices of non-landed private homes rose in the third quarter, even as transaction volumes fell 7.3 per cent.

Overall resale prices gained 3.2 per cent to hit a record $1,156 per

square foot (psf), led by a 2.5 per cent month-on-month increase in

September, data from the latest SRX Residential Property Flash Report

released yesterday showed.

The rest of central region (RCR) posted the strongest quarterly gain of

7.1 per cent for resale non-landed in Q3, hitting an historic high of

$1,199 psf. This was followed by a smaller gain of 3 per cent in outside

of central region (OCR) to $921 psf, and a muted increase of 0.75 per

cent in the core central region (CCR) to $1,738 psf.

Resale transaction volume fell 7.3 per cent to 3,296 transactions from 3,555 transactions in Q2.

RCR recorded the largest drop in transaction volume, by 10.9 per cent

to 854 transactions, followed by CCR which saw transactions drop 6.2 per

cent to 662 transactions. Transaction volumes in OCR fell 5.8 per cent

to 1,780 sales.

Meanwhile, rental volumes fell 5.2 per cent in Q3, to 7,723

transactions. Only RCR posted a marginal 0.25 per cent increase in

rental transactions, to 2,423. OCR posted the largest drop of 8.5 per

cent to 2,777 transactions while CCR saw rental transactions slip 6.2

per cent to 2,523.

Overall rental prices per square foot rose 2.9 per cent to $3.87 psf in

Q3. Rents for CCR were $4.68 psf, $4.01 for RCR, and $3.05 for OCR.

Gross rental yields remained stable at 4 per cent in Q3 due to a

corresponding increase in rental prices compared with resale prices.

By comparison, URA's flash estimate released earlier this month showed

that home prices had inched up 0.5 per cent in Q3. This took into

account new sales, which fell 2.2 per cent. It also did not take into

account the last three weeks of September sales. URA uses a different

methodology from the average psf pricing approach, which is adopted by

the SRX index.

Source: Business Times – 6 October 2012

Sentosa Cove bungalow market picks up after post-ABSD freeze

Activity in Sentosa Cove's bungalow market has picked up considerably

in the last four to six weeks, following a relatively dry period

following last December's introduction of the additional buyer's stamp

duty (ABSD) targeting foreign buying of residential properties.

BT understands that owners have issued options to buyers for about a

dozen homes in the past two months. The buyers are predominantly

foreigners, mostly China nationals.

These bungalows are said to include two homes on Pearl Island, both of

which sold at $2,200-plus per sq ft on land area. A unit on Paradise

Island went for about $22 million or slightly over $2,380 psf based on

land area of 9,236 sq ft; a property on Coral Island changed hands at

$16.5 million or $1,743 psf on land area of 9,464 sq ft.

A seafronting property at Cove Grove boasting views

of the Southern Islands is believed to have been sold for around $26

million, or $2,600 psf. This is in the neighbourhood of the one BT

Weekend reported on Sept 15 as being sold for around $24 million or

$2,470 psf.

The same edition of BT also reported two transactions on Cove Drive for

units facing the waterway and Tanjong Golf Course at $15-plus million

each. One was sold to a Myanmar citizen at $15.3 million or $2,202 psf.

Since then, BT has learnt of another purchase of a property a little

further away on the same road, but also facing the waterway and golf

course. The price is thought to be $16.8 million or $2,308 psf.

Homes on Sentosa Cove have 99-year leasehold tenure.

Market watchers attribute the recent revival in both viewings and

transactions to a cocktail of factors - the stockmarket run-up, which in

turn has boosted sentiment, QE3 and a narrowing in the bid-ask gap that

kickstarted the first few deals in the latest resurgence.

A point to note, however, is that while there is anecdotal evidence of a

string of options for bungalow purchases in the upscale waterfront

housing district being granted in recent weeks, evidence of caveats is

relatively scarce, as most of the options have yet to be exercised by

the buyers.

Caveats were lodged for six Sentosa Cove bungalow purchases in the

first half of this year, followed by two more since then. This compares

with 25 caveats for the whole of last year.

Sources suggest some foreign buyers may have sought longer than the standard two-week option period with a view to securing Singapore permanent resident (PR) status in a bid to lower their stamp duty outlay.

In addition to the 3 per cent standard buyer's stamp duty payable for

all property purchases in Singapore, including those by Singapore

citizens, a Singapore PR pays a 3 per cent ABSD for his second and

subsequent residential property purchases here.

For non-PR foreigners, a 10 per cent ABSD is payable on all residential property purchases.

Hence, if a foreigner obtains PR status, he would be able to "save" 7

per cent on ABSD, or $1.4 million on a $20 million bungalow purchase on

Sentosa Cove, assuming he already owns an existing non-landed

residential property here.

But if this PR does not own any other existing residential property

here, he does not have to pay ABSD at all - translating to a "saving" of

10 per cent or $2 million.

Word on the Cove is that some foreign buyers have been granted long

option periods ranging from six weeks to three months, or even longer.

In exchange for this, owners would typically demand a higher option fee,

say 5 to 10 per cent of the property price, compared with one per cent

in a standard deal.

Typically, a buyer in the resale market who fails to exercise an option would have to forfeit the option deposit.

Some owners who have entered into such deals on Sentosa Cove are

keeping their fingers crossed that the options will be exercised.

Market watchers note that the Singapore authorities have tightened criteria for issuing PR status to high-net-worth foreigners.

On unit land price, the highest price achieved this year is $2,787 psf in May, for a seafronting property along Cove Drive.

The record price for a bungalow in Sentosa Cove was set in October

2010, by a seafronting property on Ocean Drive facing Singapore's city

container ports. It transacted at $2,989 psf. Among waterway fronting

bungalows, the highest price achieved was in September last year -

$2,613 psf for a property on Cove Drive.

The recent run-up in deals and QE3 have boosted confidence among some owners, who have started to raise asking prices.

Source: Business Times – 6 October 2012

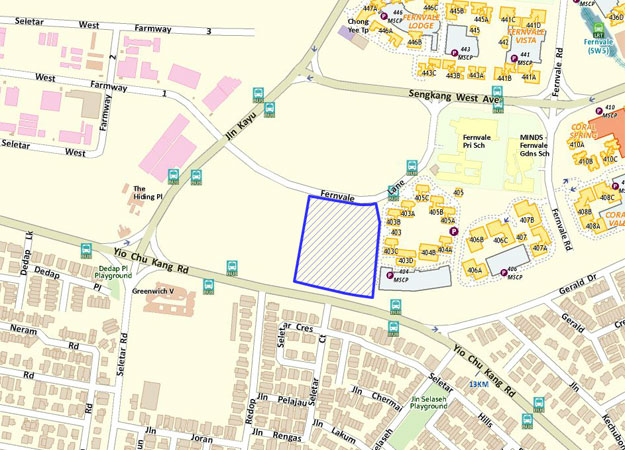

Punggol EC expected to be well received

Yet another executive condominium (EC) is being launched today, the seventh EC to be put on the market this year.

Property consultants expect Waterbay, in Punggol, to garner healthy interest from buyers, thanks, in part, to its location.

Waterbay, a 383-unit project at the junction of Punggol Central and

Edgedale Plains, is being built by Chinese developer Qingjian Realty

(South Pacific).

The company is behind several other upcoming condos in the area such as River Isles and Riversound Residence.

The smallest unit in Waterbay, a two-bedder, is 753 sq ft and has an indicative price of about $590,000 or about $780 psf.

Unusually for an EC, five-bedders are also available. These 1,496 sq ft units will cost about $1.05 million or about $700 psf.

Dual key units, which allow for multi-generational living or leasing, are also on offer.

Waterbay's launch comes about two weeks after the launch of Heron Bay EC at Upper Serangoon View, where there were 1,664 interested buyers for just 394 units.

Not all launches this year have done well, industry watchers said,

noting that buyers have been selective about price and location.

For instance, the 416-unit Watercolours at Pasir Ris was almost twice

oversubscribed, but was only 56 per cent sold as of end August.

Interested buyers for Waterbay can submit e-applications between Oct 12

and Oct 16. If demand outstrips supply, a ballot will be held.

Successful applicants can choose their units from Oct 19.

Source: The Straits Times – 6 October 2012

Watertown in Punggol almost 97% sold

The Watertown integrated development in Punggol is almost 97per cent

sold, according to developer Far East Organization yesterday.

The remaining 34 units are mainly those with three or four bedrooms, and range in size from 1,173 sq ft to 1,550 sq ft.

These are among the "best-facing units within the development

overlooking the Punggol Waterway", said Far East, which is co-developing

the project with Sekisui House.

Watertown is Punggol's first project with both a retail and residential component.

The retail portion, called Waterway Point, will feature a "24-hour

basement" level, with a FairPrice Finest supermarket and Shaw Theatres

operating round the clock.

FairPrice Finest will occupy about 30,000 sq ft of space at Waterway Point, making it one of the chain's largest outlets here.

Mr Christopher Tang, the chief executive of Frasers Centrepoint

Commercial, said yesterday: "We are delighted that NTUC FairPrice Finest

has committed to be one of the early anchor tenants.

"We are confident that the mall will be the centre of attraction at Punggol waterfront."

With total development costs estimated at over $1.6 billion, Watertown

is the largest private development in the Punggol Central master plan,

Far East added.

Shops will occupy 40per cent of Waterway Point, while eateries will

take up 30per cent. The rest will be occupied by entertainment and other

service providers, such as educational establishments, banks, and civic

and community amenities.

In August, Hyundai Engineering &

Construction was awarded the main construction contract, worth

US$380million (S$466million), for the Watertown development.

Construction of the retail component has just started and is scheduled

for completion by 2015. The residential component is expected to be

completed by 2017.

Separately, Far East said it has sold 96per cent of the units at

another of its mixed-use projects, The Hillier at Hillview Avenue.

The 528-unit development was launched in January and 21 units are left.

Source: The Straits Times – 6 October 2012

Home buyers unfazed by loan curbs

Despite new restrictions on the length of home loans that took effect

yesterday, house hunters did not stay away from condominium showflats

islandwide.

At new launches like Riversails along the Punggol waterfront and Cityscape at Farrer Park, showrooms were packed.

At a 748-unit development in Bedok South called eCO, for example, at least 20 units were sold yesterday.

The Monetary Authority of Singapore (MAS) said on Friday that it was capping the length of a home loan at 35 years.

It also lowered the loan limits for those who take loans past 30 years, or which extend beyond the retirement age of 65.

Such buyers can take a loan of only 60 per cent of the property's value, down from 80 per cent, starting yesterday.

This means an upfront payment in cash of 40 per cent of the property's price.

If it is their second or more loan, the loan limit shrinks further to

40 per cent - they must fork out a cash down payment of 60 per cent of

the property's value.

House hunters The Sunday Times spoke to yesterday said they were aware of the latest changes but they were undeterred.

Source: The Straits Times – 7 October 2012

Showflats continue to see good traffic

Neither the new restrictions on home loans nor the rain kept prospective buyers from condominium showflats over the weekend.

Indeed, it was "business as usual" at newly launched projects Riversails at Upper Serangoon View and Skies Miltonia at Yishun.

According to agents, more than 300 units have been sold at Allgreen

Properties' 920-unit Riversails, with at least 20 homes sold over the

weekend. Prices of the larger units average slightly over $800 per

square foot (psf), while the one-bedroom units average $1,000 psf.

The larger units (three-bedrooms and above) at the 99-year project have

been doing well, with quite a few sold to upgraders, noted an agent who

did not wish to be named. At the other end of the spectrum, three out

of the five stacks of one-bedroom units launched have been sold.

Separately, some 67 per cent of units at the 420-unit Skies Miltonia

have found buyers; the developer is offering an 18 per cent discount,

and throwing in the option for buyers of certain units to upgrade their

flooring to marble.

The 748-unit eCO in Bedok South threw in an additional 2 per cent

furniture voucher in addition to an array of discounts offered.

The Monetary Authority of Singapore (MAS) said on Friday that it will

set an absolute limit of 35 years on the tenure of all residential

property loans. It also lowered loan-to-value (LTV) ratios for new loans

with a tenure of more than 30 years.

According to the central bank, the average tenure for new residential

property loans jumped from 25 years to 29 over the last three years.

Over 45 per cent of new home loans have tenures exceeding 30 years.

Lower initial monthly repayments from long loan tenures and low

interest rates may cause borrowers to overestimate their loan servicing

ability, warned MAS.

Source: Business Times – 8 October 2012

A policy resolve to rein in asset prices

When the Monetary Authority of Singapore (MAS) last Friday announced

fresh mortgage curbs to prevent new bubbles from forming in the property

market, much of the attention focused on the measures and their impact.

But arguably, what is even more significant is the signal Singapore policy makers are sending to the market.

After the US unveiled a third round of quantitative easing (QE3) last

month, a BT article raised the threat of fresh liquidity flows and the

likelihood of more cooling measures to keep asset bubbles away. It was,

at the time, not the consensus view, with many

arguing, as they still do now, that existing policies are sufficient to

keep prices in check. This was especially (and not surprisingly) the view

of the real estate sector, and as recently as the end of September, the

Real Estate Developers' Association of Singapore (Redas) said the

property sector did not need another round of cooling measures, and that

a thorough review of earlier measures put in place should be done

first.

Such views, while reasonable enough in

themselves, miss the bigger point. And that is that in any robust policy

making framework, the imperative is to stay ahead of the curve.

Existing cooling measures may or may not have already reined in property

prices, but that does not define current scenarios.

A new situation has arrived with QE3. The Federal Reserve's decision to

pump US$40 billion into the US economy each month until sustained jobs

growth kicks in, while welcome news for the

struggling global economy, also created the risk that loose monetary

conditions in the US may push funds into the region in search of yields

and fan asset price inflation, with Singapore a likely prime target for

such flows. Indeed, QE3 also marks the start of what many see as an

extended round of global easing, with all the associated liquidity

risks.

It is in this context that the MAS is acting. "Monetary conditions

worldwide are far from normal," said Deputy Prime Minister Tharman

Shanmugaratnam, noting that the latest round of QE3 in the US and low

interest rates have made credit easy, though this will eventually

change.

"We are taking this step now to require more prudent lending, and will

continue to watch the property market carefully," said Mr Tharman, who

is also Finance Minister and MAS chairman.

And Singapore has signalled clearly it will not lag behind the

regulatory curve. Hong Kong, notably, moved to introduce mortgage curbs

immediately after QE3 was announced. In its fifth round of

mortgage-tightening measures, the Hong Kong Monetary Authority announced

that it would limit the maximum term of all new mortgages to 30 years.

Additionally, mortgage payments for investment properties cannot be more

than 40 per cent of buyer's monthly incomes, compared with 50 per cent

previously.

There is some debate over whether the MAS could be acting prematurely

in the domestic context because property price increases recently have

not been so marked. Official data showed that HDB resale prices rose 2

per cent in Q3 from Q2, while private home prices gained 0.5 per cent

over the same period. Separately, the SRX Residential Property Flash

Report showed resale prices of non-landed private homes rising 3.2 per

cent in Q3.

However, it's worth pointing out that the stated policy objective has

always been that property values should move in tandem with economic

fundamentals. Economists now expect advance estimates for Q3 to show

that the economy shrank 1.8 per cent over the July to September period.

Add to Q2's seasonally adjusted 0.7 per cent quarter-on-quarter

annualised drop in GDP, and Singapore would have suffered a technical

recession, or two consecutive quarters of quarter-on-quarter

contraction. Viewed in this context, even a modest rise in property

prices could be fundamentally out of line.

So far, the property sector's reaction to the new measures has been

mixed. The changes include setting an absolute limit of 35 years on the

tenure of all residential property loans and tightening loan-to-value

(LTV) ratios for certain new loans. Redas said the measures will not

have a major impact, and the initial assessments suggest that the new

rules will affect mostly older buyers, and those looking to own more

than one property. But again, this may not be the most crucial point.

The most important point that the market should take away from the

latest MAS measures is the underlying policy resolve to keep asset

prices here in check. Singapore regulators have signalled their

intention to act, again and again if necessary, to ensure that the

runaway prices of the last cycle will not be repeated.

Last Friday's measures may be confined to the residential market and a

specific group of buyers, but the evidence is clear enough that policy

makers are prepared to introduce more measures to cool prices in

non-residential sectors for instance - where there have been some signs

of overheating - or to further curb foreign buying interest, if needed.

"We will do what it takes to cool the market, and avoid a bubble that

will eventually hurt borrowers and destabilise our financial system," Mr

Tharman said. That is as explicit as it can get.

Source: Business Times – 8 October 2012

.jpg)

.jpg)

-01.jpg)